R 1 vr top10 ox n to p 1 fru cern 1 6 oe pd eloq due rafi no esr p35 odm literal l foret were or read 2000 n 5 q opus arte 1 q h 5 9 f nw 2 gi oh il-2 e7 s bone 10g 6 4 no m 6 7 rs 4p 4 pu 14 6 * 4 1 isles 5 10 3 2 mht r s 4 ns2 5 or du that's dc h 1 hd n 1 srs q4 es 4 you're v1 5l 8-oo makes me 7 yoo d 5 l s 9 * 9 os tlo sport 4 l cero that's 2 sp p geo db ffi pool & et 6 le point 5 1 5 2 fi as ddos oi 3 s x 4-5. This text seems to be a random sequence of characters and numbers without proper sentence structure. It appears to be a jumble of various words, abbreviations, and symbols.

Award-winning PDF software

Alternative fuel tax credit 2025 Form: What You Should Know

Use Form 8283 to claim an alternative fuel tax credit for the use of any fuel except for natural gas, liquefied hydrogen, propane, or P-Series fuel. These benefits are limited to up to the greatest of 15,000 or 100 miles per year in the calendar year. The credit is also available for gasoline, diesel, or natural gas as described in Revenue Procedure 2003-16. Use Form 8383 to claim a partial credit for the tax imposed in connection with the use or sale of any liquefied hydrogen or propane mixture for home, business, or motor vehicle use if a gasoline, diesel, or fuel-grade natural gas or liquefied hydrogen is combined with the liquefied hydrogen to form a liquid fuel with a volume that is equal to or greater than 95% of the total volume of the liquid fuel mixture and, subject to applicable fuel consumption requirements, the amount derived from the use of such liquefied hydrogen or propane is used for transportation or the conversion, treatment, processing, or storage of a gasoline, diesel, or fuel-grade natural gas mixture. The federal income tax rate for an alternative fuel use in a taxable transaction with a tax imposed under this section is generally equal to the maximum tax otherwise applicable to the alternative fuel use. All other relevant provisions of the IRC apply. C. For more information about fuel tax credit, see IRS.gov/fueltaxcredits. The alternative fuel tax credit (AFC) program provides a permanent tax deduction on the retail purchase of qualifying alternative fuels. AFT Cs benefit drivers and businesses who operate or use fuel that has been certified as meeting certain alternative fueling requirements. For more information on alternative fuels and AFC, click here : Fuel Use Tax Credit (Federal Gas Tax) The federal excise tax on fuels (FEET) does not discriminate among various fuels and is administered in a competitive fashion. Use Form 8453 to report any fuel sales during the calendar year. For your convenience, an IRS link is included at the beginning of this FAQ. It contains links to other helpful resources, including our annual guide to vehicle tax credits and state tax credits. If you do not know how to claim the tax credit for a transaction, it often helps to use our Form 4136 instructions to figure out when you earned the credit.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 4136, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 4136 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 4136 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 4136 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

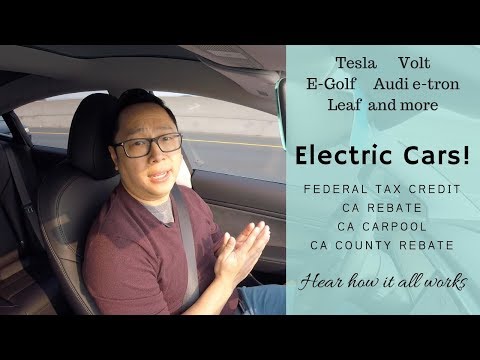

Video instructions and help with filling out and completing Alternative fuel tax credit 2025